Huntington County Indiana Property Tax Rates . Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. 2024 property tax payments are due on may 10 and november 12. Web huntington county government, indiana. Web property tax payment options. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. The taxpayer is responsible for reporting all tangible. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes.

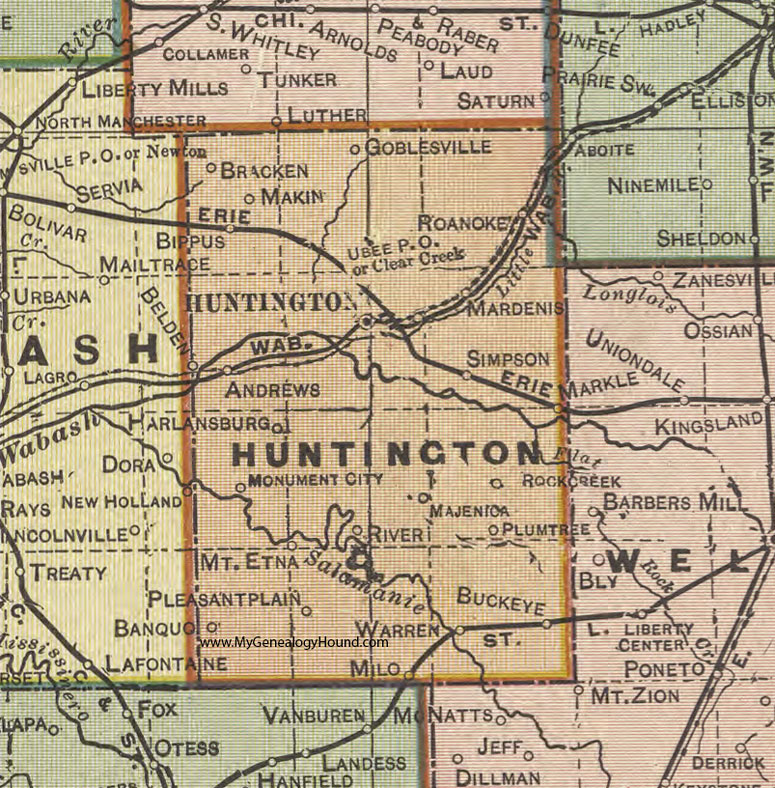

from www.mygenealogyhound.com

Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. The taxpayer is responsible for reporting all tangible. 2024 property tax payments are due on may 10 and november 12. Web huntington county government, indiana. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web property tax payment options.

Huntington County, Indiana, 1908 Map, Andrews

Huntington County Indiana Property Tax Rates Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. 2024 property tax payments are due on may 10 and november 12. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web huntington county government, indiana. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. The taxpayer is responsible for reporting all tangible. Web property tax payment options. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value.

From cesbfcyj.blob.core.windows.net

Huntington Indiana County Council at Jeannine Hall blog Huntington County Indiana Property Tax Rates Web huntington county government, indiana. 2024 property tax payments are due on may 10 and november 12. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value.. Huntington County Indiana Property Tax Rates.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Huntington County Indiana Property Tax Rates Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web property tax payment options. 2024 property tax payments are due on may 10 and november 12. The taxpayer is responsible for reporting all tangible. Web huntington county government, indiana. Web the median property tax (also known as real estate tax). Huntington County Indiana Property Tax Rates.

From godmasterginrai.blogspot.com

indiana real estate taxes Benjamin Huntington County Indiana Property Tax Rates 2024 property tax payments are due on may 10 and november 12. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web the order contains the state's certification. Huntington County Indiana Property Tax Rates.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Huntington County Indiana Property Tax Rates Web property tax payment options. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web huntington county government, indiana. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web the order contains the state's certification of the. Huntington County Indiana Property Tax Rates.

From phillidazjenna.pages.dev

Gis Huntington County Indiana Sella Daniella Huntington County Indiana Property Tax Rates The taxpayer is responsible for reporting all tangible. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web property tax payment options. Web huntington county government, indiana. 2024 property tax payments are due on may 10 and november 12. Web the order contains the state's. Huntington County Indiana Property Tax Rates.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Huntington County Indiana Property Tax Rates Web huntington county government, indiana. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. The taxpayer is responsible for reporting all tangible. Web property tax payment options. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web the median property tax (also. Huntington County Indiana Property Tax Rates.

From www.huntington.in.us

About My Tax Bill / City of Huntington, Indiana Huntington County Indiana Property Tax Rates Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web huntington county government, indiana. 2024 property tax payments are due on may 10 and november 12. Web property. Huntington County Indiana Property Tax Rates.

From www.templateroller.com

State Form 51781 Download Fillable PDF or Fill Online Indiana Property Huntington County Indiana Property Tax Rates The taxpayer is responsible for reporting all tangible. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web property tax payment options. 2024 property tax payments are due on may 10 and november 12. Web the median property tax (also known as real estate tax) in huntington county is $874.00. Huntington County Indiana Property Tax Rates.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Huntington County Indiana Property Tax Rates 2024 property tax payments are due on may 10 and november 12. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. The taxpayer is responsible for reporting all tangible. Web huntington county government, indiana. Web property tax payment options. Web the huntington county treasurer is responsible for the collection of. Huntington County Indiana Property Tax Rates.

From lotteqbertina.pages.dev

Indiana County Tax Rates 2024 Miran Huntington County Indiana Property Tax Rates Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web property tax payment options. Web huntington county government, indiana. The taxpayer is responsible for reporting all tangible. Web the median property tax (also. Huntington County Indiana Property Tax Rates.

From learningsjamangh.z21.web.core.windows.net

Nc County Tax Rates 2024 Huntington County Indiana Property Tax Rates Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web property tax payment options. The taxpayer is responsible for reporting all tangible. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web huntington county government, indiana. 2024 property tax payments are due. Huntington County Indiana Property Tax Rates.

From tashaqvitoria.pages.dev

States With Highest Property Taxes 2024 Kelly Melisse Huntington County Indiana Property Tax Rates Web huntington county government, indiana. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web property tax payment options. Web the median property tax (also known as real estate tax) in huntington county. Huntington County Indiana Property Tax Rates.

From gis.browncountyengineer.org

HUNTINGTON TAXMAP ARCHIVE Huntington County Indiana Property Tax Rates Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web huntington county government, indiana. The taxpayer is responsible for reporting all tangible. Web the order contains the state's certification of the approved budget, the certified net assessed value, the tax rate,. Web the median property tax (also known as real estate tax). Huntington County Indiana Property Tax Rates.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Huntington County Indiana Property Tax Rates Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web property tax payment options. Web huntington county government, indiana. 2024 property tax payments are due on may 10 and november 12. Web the order contains the state's certification of the approved budget, the certified net. Huntington County Indiana Property Tax Rates.

From www.researchgate.net

Supplement. Property Tax Administration Costs in Indiana, 20062014 (US Huntington County Indiana Property Tax Rates 2024 property tax payments are due on may 10 and november 12. Web property tax payment options. Web huntington county government, indiana. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web the order contains the state's certification of the approved budget, the certified net. Huntington County Indiana Property Tax Rates.

From www.newsncr.com

These States Have the Highest Property Tax Rates Huntington County Indiana Property Tax Rates 2024 property tax payments are due on may 10 and november 12. Web huntington county government, indiana. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web property tax payment options. Web the huntington county treasurer is responsible for the collection of property taxes and. Huntington County Indiana Property Tax Rates.

From taxedright.com

Indiana Local County Taxes Taxed Right Huntington County Indiana Property Tax Rates 2024 property tax payments are due on may 10 and november 12. The taxpayer is responsible for reporting all tangible. Web property tax payment options. Web the median property tax (also known as real estate tax) in huntington county is $874.00 per year, based on a median home value. Web the order contains the state's certification of the approved budget,. Huntington County Indiana Property Tax Rates.

From www.mapsofworld.com

Huntington County Map, Indiana Huntington County Indiana Property Tax Rates Web property tax payment options. Web the huntington county treasurer is responsible for the collection of property taxes and other county taxes. Web huntington county government, indiana. The taxpayer is responsible for reporting all tangible. 2024 property tax payments are due on may 10 and november 12. Web the median property tax (also known as real estate tax) in huntington. Huntington County Indiana Property Tax Rates.